File IRS Form 2290 Online Today

Get Stamped Scheduled 1 within Minutes

Pricing starts at $9.90

We are now accepting Form 2290 for the 2021-2022 Tax Year. File Form 2290 Now

IRS Tax 2290 - An Overview

Form 2290 is a tax form used to report Heavy Vehicle Use Tax (HVUT). It must be filed by truckers who own and operate heavy vehicles with a gross weight of 55,000 pounds or more on public highways.

By filing Form 2290, truckers will receive a Stamped Schedule 1 from the IRS, which acts as proof of HVUT filing and is required for tags and vehicle registration at the Department of Motor Vehicle (DMV).

Heavy vehicles with a gross weight of more than 55,000 pounds and operating less than 5,000 miles (7,500 for Agriculture vehicles) on public highways are excluded from paying the tax. However, the truckers must file Form 2290.

Visit https://www.expresstrucktax.com/hvut/irs-form-2290/ to know more about

IRS Form 2290.

IRS Tax 2290 Due Date

Usually, August 31 is the deadline for filing Form 2290 for the tax period from July 1st of the current year to June 31st of the following year for the taxable Vehicles that have July as the First Used Month.

For taxable vehicles that have the first used month other than July, file Form 2290 by the last day of the month after your first used month.

File Form 2290 in a few simple steps and get your schedule 1 in minutes!

Visit https://www.expresstrucktax.com/hvut/irs-form-2290-due-date/ for more information about the Form 2290 deadline.

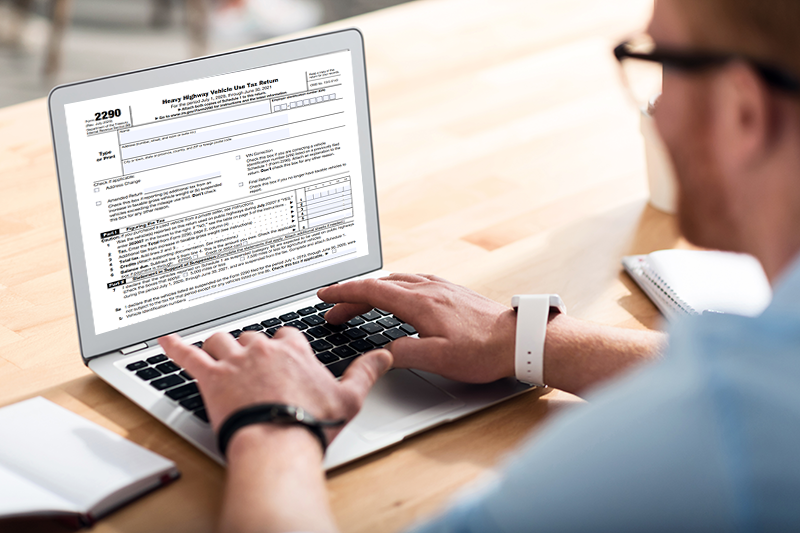

How to File IRS Tax 2290?

IRS tax Form 2290 can be filed electronically or by paper.

It’s more tedious when you choose to file 2290 by paper as it requires more manual process. You have to complete the calculations manually, then print & postal mail them to the IRS. Also, it takes more than 6 weeks to receive Stamped Schedule 1 from the IRS.

By choosing the e-filing method, you can instantly transmit the Form to the IRS and receive Stamped Schedule 1 in minutes!

With irstax2290.com, you can quickly e-file Form 2290. We provide detailed instructions at each step to complete and submit Form 2290.

Visit https://www.expresstrucktax.com/hvut/e-file-form-2290-online/ to learn about filing Form 2290 electronically with the IRS.

Information Required to File IRS Tax 2290

Business Details such as Employee Identification Number (EIN),

Name and Address.

Vehicle Details such as First used Month (FUM), Vehicle Identification Number (VIN), Taxable Gross Weight Category and

Suspender Vehicle (If any).

Click here to know more about Form 2290 instructions.

About IRSTax2290.com

irstax2290.com is the #1 authorized provider for filing your Form 2290 electronically. With our Software, you can easily file Form 2290 within minutes. You can e-file an error-free tax return with the help of our built-in audit check to ensure a fully completed form.

Our US-based support team helps you resolve your questions about the e-filing of

Form 2290 or filing status.

Advantages of E-Filing Form 2290 with irstax2290.com

- IRS Authorized

- Receive Stamped Schedule 1 in Minutes

- Free VIN Correction

- Supports Amendment

- File from any device

- Guaranteed Schedule 1 or

Your Money Back - Re-transmit Rejected Returns for Free

- Claim Tax Credits

How to E-file IRS Tax 2290?

Visit https://www.expresstrucktax.com/

efile/irs2290/ to learn more about

2290 form filing.

E-file Form 2290 Now and Get Schedule 1 in minutes!

E-File Form 2290 NowFeatures

Get Schedule 1 in minutes

Free VIN Corrections

Guaranteed schedule 1 or Money Back

Support 2290 Amendments

Support 8849 (Schedule 6)

File from any Mobile Device

E-file Form 2290 Now and Get Schedule 1 in minutes!

E-file Form 2290 NowFile IRS Tax 2290 from Mobile

File IRS Tax 2290 online conveniently from your mobile. Download our mobile app today. File your 2290 on the go! Get IRS stamped 2290 schedule 1 in minutes.

Frequently asked questions on IRS Tax Form 2290

- How long does it take to get my stamped Schedule 1 (proof of HVUT payment) ?

- I put my vehicle on the road after July. Do I have to pay the full tax ?

- What is Taxable Gross Weight ?

- How do I update IRS Form 2290 if my gross taxable weight

increased ? - I filed my 2290 claiming mileage, not exceeding 5k miles. Recently, the mileage limit exceeded the threshold. How do I account for this ?